IBAN is utilized by nearly all American nations at this time and some places from American Asia. The key purpose of virtual iban providers would be to facilitate intelligent processing of money moves, prevent setbacks and any added expenses due to the use of improper consideration figures in money transfers. The overall design of consideration numbering practices and quantity models is different from state to country and each bank codes are different and that leads to problems and delays in the completion of bank transfers.

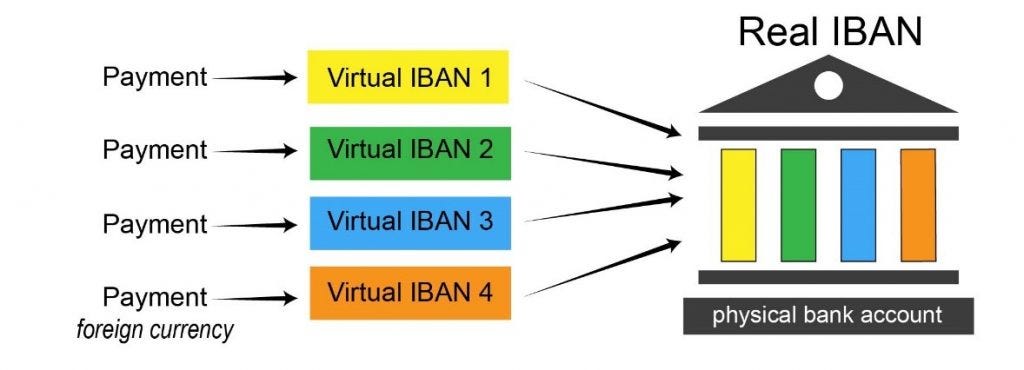

As the business and financial transfers are globally raising, the necessity has arisen to develop a particular quantity for move of resources in domestic and foreign currencies. IBAN has been designed to handle this kind of concern and facilitate digital banking transfers through the complete and obvious sign of the beneficiary bill number in move orders. IBAN enables sender banks to confirm the validity of the presented beneficiary bill number.

IBAN countries (countries that use IBAN) produce an IBAN for each of the bank-account numbers. It includes both check digits which are calculated with a particular mathematical algorithm. The consumer, who plans to make a cost transfer, provides the beneficiary’s IBAN to the sender bank, the sender bank will validate the always check numbers of IBAN before the cost move reaches the beneficiary’s bank. If the beneficiary’s IBAN is incorrect, the payment move is going to be ended before transmitting it to the beneficiary’s bank.

Electric money moves aren’t just utilized in reference to foreign currency change payments, however in a bunch of different obligations specially when bigger amounts are involved such as for instance house, cars, ships, actually anything. Today, EUROPEAN CROSS BORDER PAYMENTS are created easier for the events to send, because of the usage of IBAN which means International Bank Bill Quantity for short.

IBAN is just a bank code which determines the bill number and extra heroes, thus avoiding possible mistakes. It should be noted however, that its validation is no promise that the bill number or bank signal is correct or so it exists. It’s the obligation of the account manager to alert their IBAN to the celebration they wish to offer with.

The IBAN is provided for the consideration by the bank providing that consideration, and should only be taken from that bank. It stops finding probable incorrect IBAN facts, as this will cause delay in getting payment. Nobody wants any setbacks when making foreign currency change payments. Companies coping with global money transfers are very correct and are anxious to improve one currency against another as quickly while they possibly can, to accomplish the offer and display their clients how efficiently and easily they perform.

The financial institution recognition signal BIC is still another abbreviation, which you should come across. BIC is just a method of being able to recognize economic institutions so that the means of telecommunication in economic institutions/banks is facilitated. To be able to make a cost, it is needed to estimate the IBAN and BIC. The utilization of IBAN became compulsory since July 2003. Most people have been aware of the abbreviation SWIFT, which represents Culture for World wide Interbank Economic Telecommunication

SWIFT is a global provider of secure economic message service. It’s that support that international currency exchange organizations use to maneuver the money bank to bank. It can be the exact same service constantly used to maneuver countless kilos and different currencies by countless other economic institutions. It is quickly and safe. When coming up with international currency moves you will just need certainly to fill in a questionnaire, which the business you select to complete the business enterprise with can provide. The several previously discussed facts, serve only to share with those, who hope to learn what specific abbreviations really mean, and also a small explanation here and there.

The term income transfer support refers to the ability to transfer income from one person (or institution) to another. The quickest and best approach to moving funds is via bank line transfers, the procedure for such a move is as follows: The person who wishes to implement the transfer says their bank of the quantity of money to be paid in addition to the lender details of the payee; these facts will include the IBAN and BIC code.